How to Form a Corporation in Arizona

Start an Arizona Corporation

If you intend to grow a large business that brings in significant capital, or you intend to file taxes as a nonprofit organization, then an Arizona Corporation is right for you. Form your corporation with us and you get:

- fast formation

- one year of AZ Statutory Agent service

- secure online account

- compliance service enrollment (no upfront fees)

- free mail forwarding (3 docs/yr)

- website + phone service (FREE for 90 days)

- domain (FREE for one year)

- legal advice (FREE for 60 days)

- NO PUBLISHING COSTS

All new Arizona Corporations are required to publish news of their formation. It’s a hassle and a time suck—BUT, if you form your corporation with Arizona Statutory Agent, you can skip this antiquated requirement. How? We’re located in Maricopa County. Companies here are auto-published in the state’s database.

Reduce your workload with our Arizona Incorporation Package—we’ll file your formation documents on your behalf so you can focus on your business. Or, if you prefer to file on your own, we’ve got a DIY Incorporation guide to help you out.

What you’ll find on this page:

No Publishing Costs

When You File With Us!

Includes State Fees

Skip the AZ publication requirement and save your Corporation time & money.

Get an instant address you can use for the long haul. Plus no publishing costs with our Maricopa County address!

What you get with our Incorporation package:

Incorporation • One Year Registered Agent Service • Business Address •

FREE Corporate Bylaws •

Mail Scanning • Annual Compliance Service •

Domain • Website • Virtual Phone •

Lifetime Customer Service

Arizona Corporation vs. LLC

Like Arizona LLCs, Arizona Corporations give their owners liability protection. Unlike LLCs, however, corporations have the ability to issue stock, which means they’re owned by shareholders rather than a single person or a small group of individuals. This can make a corporation more attractive to investors because—by owning stock in a company—they effectively hold an ownership stake, which means they tend to profit when your company does.

Why Trust Arizona Statutory Agent With Your Corporation?

Privacy

Businesses formed in Arizona are required to list their members or managers publicly. But, that doesn’t mean you have to make your personal address public, too. When we incorporate your business in Arizona, we list our address on your formation documents instead of yours. Plus, unlike most of our competitors, we will never share or sell any of your data.

Localized Expertise

We understand business filings in Arizona better than most. Unlike the big, national corporations that provide the same service, we actually live here in Maricopa County, AZ and we’re focused entirely on our state. We’re here to share our years of experience with you through our friendly local customer support.

Streamlined Services

We provide a slew of services to meet the needs of your business. Whatever you choose for your business, everything will be accessible to you in one secure, online account.

Exceptional Value

Our Incorporation filing service is just $100 on top of the state’s filing fee. It also comes with a comprehensive assortment of internal documents, like your corporate bylaws. Plus, thanks to our Maricopa County address, you can avoid the state’s publication requirement, saving you time and money. As statutory agents, we pride ourselves on offering the best statutory agent service in Arizona, at the lowest rate, year after year. No introductory rates, and no price hikes. Just $49 a year, every year. Plus, our incorporation service gives you at no additional cost:

- A Business Address – We use our address instead of yours on your formation documents, giving you a professional Business Address for free so you can keep your own address private.

- Mail Forwarding – Get 3 pieces of non-registered mail forwarded to your online account each year, absolutely free. Need more mail than that? Upgrade to one of our Mail Forwarding services or Virtual Office at no extra charge.

- Business Presence – Create a full-blown online business presence (domain + website and security + email + phone) for free with our incorporation service. All services are absolutely free for the first 90 days, except for domain service which is free for an entire year!

What Our Clients Say About Us

We’re rated A+ by the Better Business Bureau, with 5/5 stars on all customer reviews.

⭐⭐⭐⭐⭐

Amos was amazing! …He stayed on the phone from start to finish to make sure I had everything I needed and was all squared away. Overall great experience thanks to Amos!

– Cameron S

⭐⭐⭐⭐⭐

After purchasing the registered agent service, Amos emailed me all the documents and information I needed to complete the LLC registration process myself. Great experience!

– Mel T

⭐⭐⭐⭐⭐

My domain setup was smooth. Great service!! Thank you, Jason! For clarifying what exactly I needed to properly set up my domain. Thank you, ASA Team!

– Christine C

DIY Guide: Steps to Form an Arizona Corporation

Want to file on your own? Here are the steps you’ll need to follow to incorporate in Arizona:

- Choose a Name for Your Arizona Corporation

- Appoint an Arizona Statutory Agent

- Prepare and File Your Articles of Incorporation

- Build Your Business Presence Online

- Publish A Business Notice (except in Pima or Maricopa County)

- Draft Corporate Bylaws

- Obtain an Employer Identification Number (EIN)

- Obtain Necessary Licenses and Permits

- Optional: Get an Assumed or Fictitious Name (DBA) for Your Corporation

Choose a Name for Your Arizona Corporation

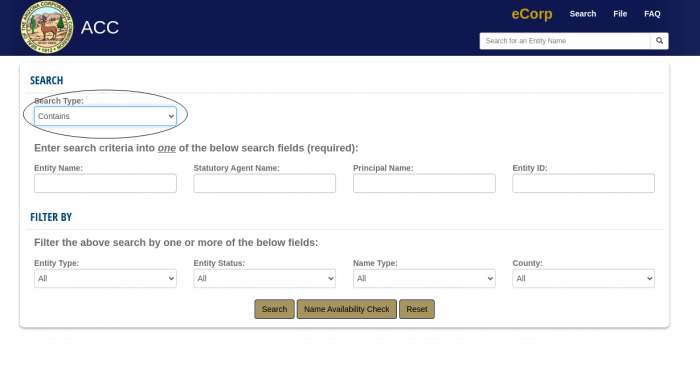

It’s a good idea to do an Arizona business name search with the Arizona Corporation Committee to make sure your preferred name is available. Note that your business name doesn’t only have to be available, it must be distinguishable from all other registered business names in the state, which means it can’t be too similar to any other registered name. To ensure your chosen name is unique enough, we recommend searching for any names that contain any part of your business name.

You’ll also have to make sure your business name has a business-type indicator at the end of it, like “Corporation” or “Inc.” For more information about naming restrictions, see the ACC’s guidelines for determining whether a business name is distinguishable.

Appoint a Statutory Agent

All registered businesses in Arizona, including corporations, are legally obligated to appoint a statutory agent. (Most states refer to this as a registered agent.) Your statutory agent is responsible for accepting lawsuits and other legal or state notices on behalf of your business. It’s an important job, so you want to make sure you have a reliable statutory agent you can trust.

An Arizona Statutory Agent must: be over 18, have a physical address in Arizona, and commit to being available at that address to accept documents on behalf of your company during regular business hours. While a fried or relative can serve in this capacity for you, the requirements for statutory agents are too rigid for most people. That’s why many businesses trust statutory agent services, like ours.

When an Arizona Corporation files their articles of organization by paper: They must include a signed statutory agent consent form. If you hire us as your agent, you will have a signed copy in your secure account upon signup.

When an Arizona Corporation files their articles of organization online: They must enter all the agent information correctly, so the state can properly send the consent request to the agent for acceptance before the request expires and the corporation must be resubmitted. If you hire us as your agent, your automatic confirmation email will include all the details you need to file accurately.

When an Arizona Corporation hires us to file their articles of incorporation: We list all of our own information and immediately accept the appointment so there is no delay in the corporation’s registration.

Complete and File the Articles of Incorporation

To officially register your corporation with the Arizona Corporation Commission, you have to complete and file a document known as Articles of Incorporation. This information can be submitted online, by paper, or through hiring a third party, like us. When you hire us to start your corporation, we always file online to make sure the process happens as quickly as possible.

Here’s what your Articles of Incorporation should include:

- indication if it’s a nonprofit corporation, a for-profit corporation or a professional corporation (professional services only)

- business name

- professional service (only applies to professional corporations)

- character of business (type of industry and/or service provided)

- number of members (nonprofit) or shares (for-profit)

- principal address

- name and business address of each director

- statutory agent name and address

- name, address and signature from each incorporator

Your articles must be accompanied by a Certificate of Disclosure.

If you choose to file by paper, you can submit the articles of organization, cover sheet, certificate of disclosure, and the statutory agent consent form to:

By email:

[email protected]

By fax:

602-542-3521

By mail:

Arizona Corporation Commission – Examination Section

1300 W. Washington St., Phoenix, Arizona 85007

| Filing Method | Fee | Processing Time |

| Paper- Standard (for-profit) Paper- Standard (nonprofit) | $60 $40 | 7-8 weeks |

| Paper- Expedited (for-profit) Paper- Expedited (nonprofit) | $95 $75 | 3+ weeks |

| Online- Expedited (for-profit) (nonprofit) | $95 $75 | 1+ day |

| Hire Us | $195 | 1 day |

Build Your Business Presence Online

Pretty much all businesses these days need a web presence to engage with a wider customer base and establish credibility. Our Business Presence package includes a FREE domain for the first year, plus a FREE 90-day trial of:

- business website + security (no coding required)

- business email (up to 10 addresses @ your domain)

- phone number and service (with an AZ area code)

After the first 90 days, each of the services listed above are $9/month individually, or if you get the entire bundle receive a 20% discount for a total of $21.60/month for all three products. Don’t know how to set up a website? Not a problem. Our web support team can build a basic website for you, or walk you through the process over the phone. If you’re not satisfied, we make it easy to cancel at any time through your online account.

Publish Business Notice

After formation, most Arizona Corporations must publish a notice of existence in their local newspaper. This must be done within 60 days of formation, three consecutive times (AZ Revised Statute § 29-3201(G)). However, corporations in Pima or Maricopa County are exempt from the publication requirement.

The good news is our office is located in Maricopa County, so when you hire us our address is listed on the state record and you can skip the publication requirement. If you choose not to hire us and form your business outside Pima or Maricopa County, here’s what will happen:

- The Arizona Corporation Commission (ACC) will send you a letter reminding you of the publication requirement.

- You’ll have to complete the attached Notice of Publication form and send it to an approved publication in your county. (See this list of approved publications.)

- After your notice has been published for three consecutive runs, the newspaper will send you an affidavit confirming that.

- We recommend filing the affidavit with the ACC right away, as the ACC may administratively dissolve your business if the publication requirement isn’t completed within 60 days.

You’ll also have to pay for publication, a cost that could range from $55-$150, depending on your country. Don’t want to bother with all this? Hire us!

Draft Corporate Bylaws

Though not required by Arizona state law, corporate bylaws are an essential internal document for your corporation. Bylaws create the rules by which your business operates. Corporate Bylaws are not only legally binding, you’ll probably need them to conduct business with banks, donors, and other financial institutions.

Many businesses hire an attorney to draft their bylaws for them, but this can be expensive. When you hire us, we include an attorney-drafted, customizable template for your Corporate Bylaws, which is tailored to suit your corporation.

Obtain an Employer Identification Number (EIN)

Employer Identification Number (EIN) is a business identification number from the IRS, also called a Tax ID. It’s like a social security number, but for your business. It’s best to apply for an EIN after your Arizona Corporation has been approved by the ACC to ensure the official name and formation date is attached to the EIN.

You can apply for an EIN for your business pretty easily on the IRS website, as long as you have a social security number (SSN). If you do not have a SSN, you’ll have to apply by mail and likely wait months to get your business’s EIN.

Obtain Necessary Licenses and Permits

You won’t need a state-wide business license to operate your corporation in Arizona. However, depending on where your business is located in Arizona, there’s a good chance you’ll have to get a local business license (or licenses). Here’s what you should anticipate:

1. Transaction Privilege Tax (TPT) License

A TPT license, otherwise known as a sales license, is necessary if you plan to sell a product or engage in some sort of activity subject to sales tax. The Transaction Privilege Tax is basically a tax business owners pay for the privilege of doing business in Arizona.

2. Local Business Licenses

Several cities and counties require businesses to obtain a local business license before they can operate there. To find our whether you’ll need to get a local license for your business, check with the city/town office in which you plan to conduct business. Be aware that if your business will have several locations, there’s a chance you’ll need to obtain several local licenses.

3. Regulatory (Professional/Special) Licensing/Permits

Highly regulated professions (i.e. medicine, law, construction) require business owners to have specialized licenses and/or permits. These could be required from any of the following:

- Federal: Federal Licenses & Permits

- State: State Regulatory Agencies

- Local: City/Town and County Departments

Register Trade Names (DBAs) for Your Corporation (Optional)

You’ll need an Arizona Trade Name for your corporation if you plan to do business under any name that’s different from the name you registered with the ACC. Getting a trade name requires you to file a trade name application online.

An easier option? Hire us to register your trade name for you. For $125 plus state fees, we’ll make sure your desired name is available and will file your application right away so you can start doing business with your new name pronto.

Get An Arizona Corporation Today!

Formation, Statutory Agent & Business Address

+ Get a Free Domain for 1 Year