Arizona LLC Formation

Forming your Arizona LLC with Arizona Statutory Agent doesn’t just make your job easier, it helps make your business better. Our service is reliable, efficient, and includes added benefits at no extra charge:

- Same-Day Document Scans

- FREE Business Address

- FREE Mail Forwarding

- Website + Email + Phone

- Access to Arizona legal advice

- Secure Online Account

- Compliance Service Enrollment

- Expert Customer Service for the Lifetime of your Business!

Because our building is located in Maricopa County, we’re able to lower the cost of your LLC service and provide you with a dependable business address you can use on your formation documents so you can keep your own address private.

What’s more, all our services are offered in-house. This makes it easy for you to upgrade products like mail service as the needs of your business grow. No matter the size of your company, Arizona Statutory Agent has got your back.

What you’ll find on this page:

FAQ: Arizona Limited Liability Company

No Publishing Costs

When You File With Us!

Includes State Fees

With our Maricopa County statutory agent address, you can skip the Arizona publication requirement and save your LLC time and money.

What you get with our LLC formation package:

LLC Formation • One Year Registered Agent Service • Business Address • FREE Operating Agreement

Mail Scanning • Annual Report Reminders

Domain • Website • Virtual Phone

Lifetime Customer Service

FAQ: Arizona Limited Liability Company

Why start an Arizona LLC?

LLCs are relatively inexpensive to start in Arizona and by default do not pay corporate taxes at the state or federal level. An Arizona LLC allows individuals or entities to do business in Arizona while enjoying flexibility, liability protection, and personal asset protection. Though newly formed LLCs in Arizona have a publishing requirement, this doesn’t apply to companies in Pima or Maricopa County.

Guess what? We’re located in Maricopa County, which means that when you form your business with us you can completely ignore the $55-$150 publishing fee.

How do I register an LLC in Arizona?

To register your LLC, you’ll need to appoint a registered agent, file your LLC’s Articles of Organization with the Arizona Corporation Commission, and publish a notice of formation in a local newspaper within 60 days of having your Articles approved by the state.

Additional steps include drafting an operating agreement, getting an Employer Identification Number, and submitting a Beneficial Ownership Information report. Plus, you’ll want to launch your website and otherwise prepare your LLC to do business.

Reduce your Workload with Our Arizona LLC Formation Package

We’ll file on your behalf so you can focus on doing business.

Or, if you prefer to file on your own, we’ve got a DIY LLC Filing Guide to help you out.

Why Trust Arizona Statutory Agent With Your LLC?

Exceptional Value

We pride ourselves on offering the best statutory agent services, at the lowest rate year after year in Arizona. We don’t do introductory rates, and we don’t do price hikes. As a local business who isn’t trying to be everything to every business, we keep our statutory agent service priced at $49 a year, every year. Our LLC formation filing is $100 on top of the state’s fee. That includes a comprehensive packet of internal documents like your LLC operating agreement, and with access to our Maricopa County address, you save money and time by eliminating the publication requirement.

Privacy

Arizona is a state that requires LLCs to list their members or managers publicly. There’s no getting around that. But, that doesn’t mean you should have to list your private address publicly too. With our services, use of our address on public record is included. We also guarantee that we will never share or sell any of your data.

Localized Expertise

When you hire a local statutory agent instead of a big, national corporation to start your LLC, you’re hiring people who specialize in understanding the ins and outs of Arizona businesses. We’re here to share our years of experience with you through our friendly local customer support.

Streamlined Services

Our services are tailored to meet the real needs of real Arizona businesses. Hire us for as many or as few services as you need, and keep everything in one secure, online account.

What Our Clients Say About Us

We’re rated A+ by the Better Business Bureau, with 5/5 stars on all customer reviews.

⭐⭐⭐⭐⭐

Easy, quick, convenient. Starting an LLC can be overwhelming, but with this service it was smooth, and worth every penny. I highly recommend using Arizona statutory agent for anybody looking into starting an LLC.

– Julio G

⭐⭐⭐⭐⭐

This was our first experience using a statutory agent. Wish I’d known about them years ago. Set up was so easy. Each step is explained with examples for perfect understanding. There was no wondering what would happen next.

– MaryAnn

⭐⭐⭐⭐⭐

Arizona Statutory Agent Services LLC got my LLC up and running literally overnight and proactively communicated with me via email every step of the way. I would absolutely recommend working with this organization for a hassle free experience!

– Amy V

Get Started on Your Arizona Articles of Organization

Ready to jump right in? Start filling out your LLC Articles of Organization with our free online form. You can use this form to file on your own or file with us. And if you don’t feel like completing the entire form in one sitting, you can save your progress and come back to finish it later.

Steps to Form an Arizona LLC

Here are the basic steps to creating an LLC in Arizona:

- Choose a Name for Your Arizona LLC

- Appoint a Statutory Agent

- Prepare and File Your Articles of Organization

- Build Your Business Presence Online

- Publish Business Notice (except in Pima or Maricopa County)

- Create an Operating Agreement

- Obtain an Employer Identification Number (EIN)

- Obtain Necessary Licenses and Permits

- Optional: Get an Assumed or Fictitious Name for Your LLC

Choose a Name for Your Arizona LLC

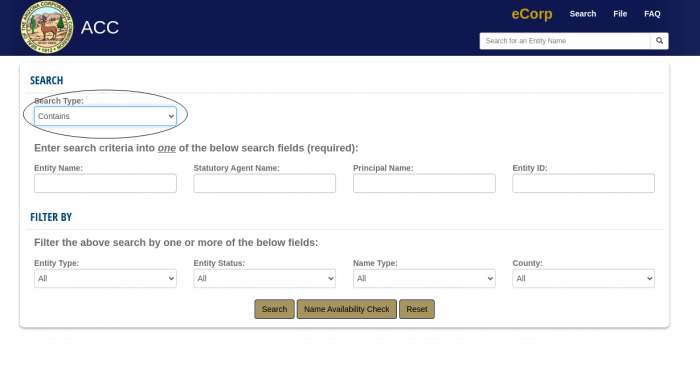

Before finalizing the name of your LLC, do an Arizona business name search to make sure it’s available by searching the Arizona Corporation Commission: Business Entity Search. Your business name must be distinguishable from all other registered business names in the state, which means it can’t be confusingly similar to another name. We recommend searching for any names that contain any part of your business name to ensure another business name isn’t too close to your Arizona LLC’s name. You can also read the ACC’s guidelines for determining whether a business name is distinguishable.

Once you’ve confirmed that your chosen LLC name isn’t too similar to other Arizona business names, make sure that you add an LLC indicator, like “LLC,” or “limited liability company” at the end of the business name.

Appoint a Statutory Agent

All Arizona LLCs must appoint an Arizona statutory agent in their Articles of Organization. In most other states, what we call a statutory agent is called a registered or resident agent. No matter what you call it, it’s the same thing. A statutory agent is a qualified individual or entity, legally committed to accept lawsuits and other legal or state notices on behalf of the business.

To qualify as a statutory agent, the individual or entity must have a physical address in Arizona, be over 18, and commit to being available to accept documents on behalf of the company during any and all regular business hours. To guarantee that the statutory agent commits to accepting legal and state notices for the business, Arizona requires the appointed statutory agents to consent to each appointment.

When an Arizona LLC files their articles of organization by paper: They must include a signed statutory agent consent form. If you hire us as your agent, you will have a signed copy in your secure account upon signup.

When an Arizona LLC files their articles of organization online: They must enter all the agent information correctly, so the state can properly send the consent request to the agent for acceptance before the request expires and the LLC must be resubmitted. If you hire us as your agent, your automatic confirmation email will include all the details you need to file accurately.

When an Arizona LLC hires us to file their articles of organization: We list all of our own information and immediately accept the appointment so there is no delay in the LLC’s registration.

Complete and File the Articles of Organization

Complete and submit the Articles of Organization to officially form your Arizona LLC with the Arizona Corporation Commission. To file your articles, you can submit the form online, by paper, or through hiring a third party, like us. When you hire us to start your LLC, we always file online to get your paperwork back as quickly as possible. Regardless of the method of filing you choose, you should expect to provide the following information:

- indication if it’s an LLC or PLLC (professional services only)

- business name

- industry (only applies to PLLCs)

- statutory agent name and address

- principal address

- management structure (member managed or manager managed)

- members/managers names’ and addresses

Even with the additional fee for expediting your LLC, Arizona’s online filing fee is less expensive than the filing fee in most other states, and well worth the ease and speed.

If you choose to file by paper, you can submit the articles of organization, cover sheet, management structure attachment for managers OR members, and the statutory agent consent form to:

By email:

[email protected]

By fax:

602-542-3521

By mail:

Arizona Corporation Commission – Examination Section

1300 W. Washington St., Phoenix, Arizona 85007

| Filing Method | Fee | Processing Time |

| Paper- Standard | $50 | 7-8 weeks |

| Paper- Expedited | $85 | 3+ weeks |

| Online- Expedited | $85 | 1+ day |

| Hire Us | $185 | 1 day |

Build Your Business Presence Online

In today’s digital age, a website and online presence are essential for businesses to reach and engage with a wider audience, establish credibility, and remain competitive in their markets. Whether you offer services or products, online or in-person, most businesses need an online presence.

Our Business Presence package includes a FREE domain for the first year, plus a FREE 90-day trial of our other Business Presence services:

- Customizable Business Website + Security (no coding required)

- Professional Email Service (Up to 10 addresses @ your domain)

- Virtual Phone Service (with an Arizona area code)

After the first 90 days, services are $9/month individually or $21.60/month for all three services. You get a 20% discount for bundling all services. If you’re not technically inclined, don’t worry. Our web support team can walk through the process of designing your website over the phone. If you’re not satisfied, we make it easy to cancel at any time through your online account.

Publish Business Notice

Most Arizona LLCs must publish notice of the formation in their local newspaper within 60 days of formation three consecutive times, per AZ Revised Statute § 29-3201(G). However, LLCs in Pima or Maricopa County are exempt from the publication requirement.

Our office is located in Maricopa County so when you hire us to serve as your statutory agent, or to start your LLC for you, our address is listed on the state record and you can skip this (annoying and costly) step altogether. If you aren’t using our services, here’s what to expect:

- The Arizona Corporation Commission (ACC) will send you a letter once your business is approved advising you to move forward with publishing.

- You must complete the enclosed Notice of Publication form, and send it with appropriate fees to an approved publication in your county.

- After the the publication completes the required three consecutive runs, the newspaper will send you an affidavit proving your notice was published 3 times.

- We recommend filing the affidavit with the ACC right away, as the ACC may administratively dissolve your LLC if the publication requirement isn’t completed within 60 days.

Publication fees differ based on the newspaper and county and may range from $55-$150, which reinforces the value and benefit of our $49/year statutory agent service.

Create an operating agreement

An operating agreement serves as a foundational and defining document for your Arizona LLC. While not required by Arizona state law, this document serves as a rule book and record for your company by listing who makes the management decisions, how profits and responsibilities are split, and ownership and initial investment details. On top of being a helpful legal document, your LLC will likely need an operating agreement to conduct business with some third parties like banks and other financial institutions.

Most businesses create their own operating agreement, or hire an attorney to write one for them. If you choose to hire us, we include an attorney-drafted, customizable template, tailored to your LLC’s management style AND additional internal documents included in our $100 filing service fee.

Obtain an Employer Identification Number (EIN)

An “EIN” is an Employer Identification Number from the IRS, but it is also called a Tax ID. It’s the unique, 9 digit number for a company’s tax purposes. Arizona LLCs with two or more members will need an EIN, but it’s generally recommended for single member LLCs as well, especially if you prefer not to have to use your personal SSN for business purposes.

We recommend applying for an EIN after your Arizona LLC has been processed and approved so that you can ensure the official name and formation date is attached to the EIN. Applying for an EIN (if you have a SSN) can be done pretty quickly online, but making changes to an existing EIN is usually a much longer paper filing.

If you have a SSN, you can apply for your Arizona LLC’s new EIN on the IRS website. If you do not have a SSN, you’ll have to apply by paper (which may take months to have your EIN assigned).

Obtain necessary licenses and permits

Arizona does not have a standard state business license. Any other licenses or permits that may be required of your Arizona LLC will fall under one of the following three categories:

1. Transaction Privilege (Sales) Tax (TPT) License

If you plan to sell a product or engage in an activity subject to transaction privilege (sales) or use tax*, you will most likely need to obtain the state transaction privilege tax (TPT) license – commonly referred to as a sales tax, resale, wholesale, vendor or tax license – from the Arizona Department of Revenue (ADOR).

2. Local Business Licenses

Most local jurisdictions in Arizona issue business licenses.

For more information on whether or not your LLC is subject to one or more business licenses, check with each city/town office in which you plan to be based and/or conduct business.

3. Regulatory (Professional/Special) Licensing/Permits

If your LLC is involved in products or services that are more highly regulated, you likely need to obtain a specialized license or permit at the federal, state, or county/city level.

- Federal: Start by checking your industry with U.S. Small Business Administration (SBA) Federal Licenses & Permits

- State: Start by checking with the appropriate state regulatory agencies and review the Arizona Revised Statutes and the Arizona Administrative Code

- Local: Start by checking with your check with the different city/town/county departments

Optional: Register Trade Names (DBAs) for your LLC

If your Arizona LLC will operate under any names other than your legally registered name on the Articles of Organization, you will need to register an Arizona trade name (sometimes called a DBA) with the Arizona Secretary of State. This filing can be made online. You may also hire us to register your trade name after your LLC is formed for $125 plus state fees. Either way, plan in advance as the state is currently processing these filings in about 2-4 weeks and there are no expedited options.

Get Your Arizona LLC!

$234 Total

Formation, Statutory Agent & Business Address

+ Get a Free Domain for 1 Year